The Vedanta stock has been a laggard over the past 5-years owing to reasons like

- Commodity cycle bust

- High Debt/Capital Intensive Business

- Supply Chain Issues

- Inability to consolidate businesses and unlock value

Despite these reasons, the promoters are able to provide a dividend yield of 10% and higher from Vedanta and other companies under its canopy

This has been a cushion for investors despite the low performance of the stock

In the recent week, there has been another development

This is hailed by the investment community as a necessary step to deleverage the balance sheet and focus on growth and consolidation

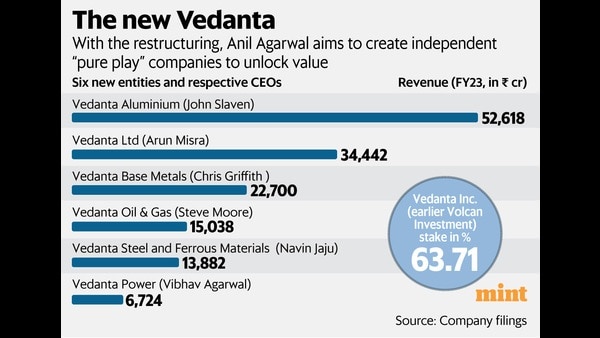

The idea is to overhaul the conglomerate that has metals, mining, and energy into six independent companies, with a plan to list five of them by FY25 (Ref)

The decision for the restructuring also comes on the back of mounting debt (which is due in a few years) and rating downgrade of Vedanta Resources Ltd (VRL), by S&P Global. Its debt obligation as as follows(Ref):

- Vedanta Resources Finance II PLC’s $1 billion dollar bonds [Maturity: 1 January 2024]

- VRL – $951 million dollar bonds [Maturity: 9 August 2024]

- Vedanta Resources Finance II PLC’s $1.2 billion bonds [Maturity: 11 March 2025]

Despite this tightrope walking, Vedanta has a lot to offer to its investors with the big stakeholders being the likes of LIC.

With the split and renewed focus on growth – the group will be able to make money for its investors once this storm blows over. It is a wait and watch or nibble in small quantities.

This quote by the veteran investor – Warren Buffet, sums everything up very well.

Hope this helps

You can follow my blog or Facebook page on investing for getting insight into other stocks.

Happy Investing!!

Leave a comment