Borrowing money, or using leverage, to invest in the stock market might seem tempting due to its potential upsides.

In today’s high rise market, we can see different stock brokers pushing a product called – MTF or Margin Trading Facility.

MTF, or Margin Trading Facility, is a product that allows investors to buy stocks by paying a portion of the total value, with the remaining amount funded by the broker. MTF is a leveraged or debt funded product, which means that investors can increase their gains without paying the full trade value.

If your investments made using MTF perform well, the returns can be amplified, allowing you to make a larger profit than if you had only used your own capital.

Please note, this is meant to be the best case scenario

Having said this, in real life, this is never the case.

Investing using borrowed money or leverage comes with its downsides.

As the stock market is inherently volatile, and even well-researched investments can take unexpected turns. If the market drops, you not only lose your own money, but you’re also responsible for repaying the borrowed amount, possibly with interest. This can lead to significant financial stress or even debt spirals, especially if the market takes time to recover.

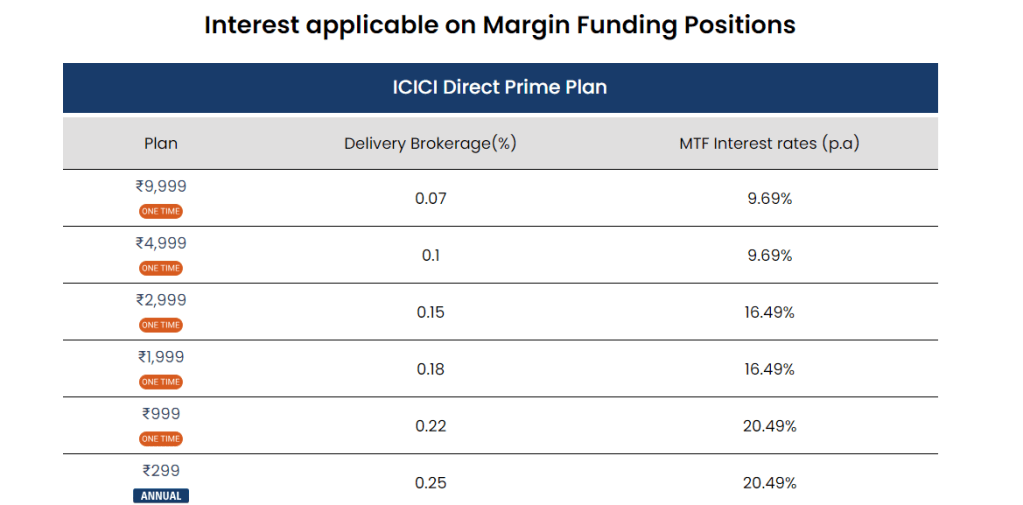

Also, apart from the principal amount borrowed as a part of leverage – the investor also has to make interest payments on the principal.

This interest payment is due even if the investor makes profit or loss

Do note that volatile markets can lead to scenarios where you sell your investments at a loss just to cover your loan obligations.

Taking these pitfalls into consideration, as an investor (new or mature) – it is better to focus on building investments with your own capital. This will protect you from added financial pressure and allow you to take risks within your comfort zone.

Remember – Leverage amplifies both profits and losses—proceed with caution.

Hope this helps

Happy Investing

God Bless!

Leave a comment