RBL Bank (previously known as Ratnakar Bank) is one of the private sector banks in India that is serving the Indian Financial space.

Like any other of significant size, it provides services in segments like:

- Corporate banking

- Commercial banking

- Branch banking with a retail focus

- Treasury and

- Financial markets operations

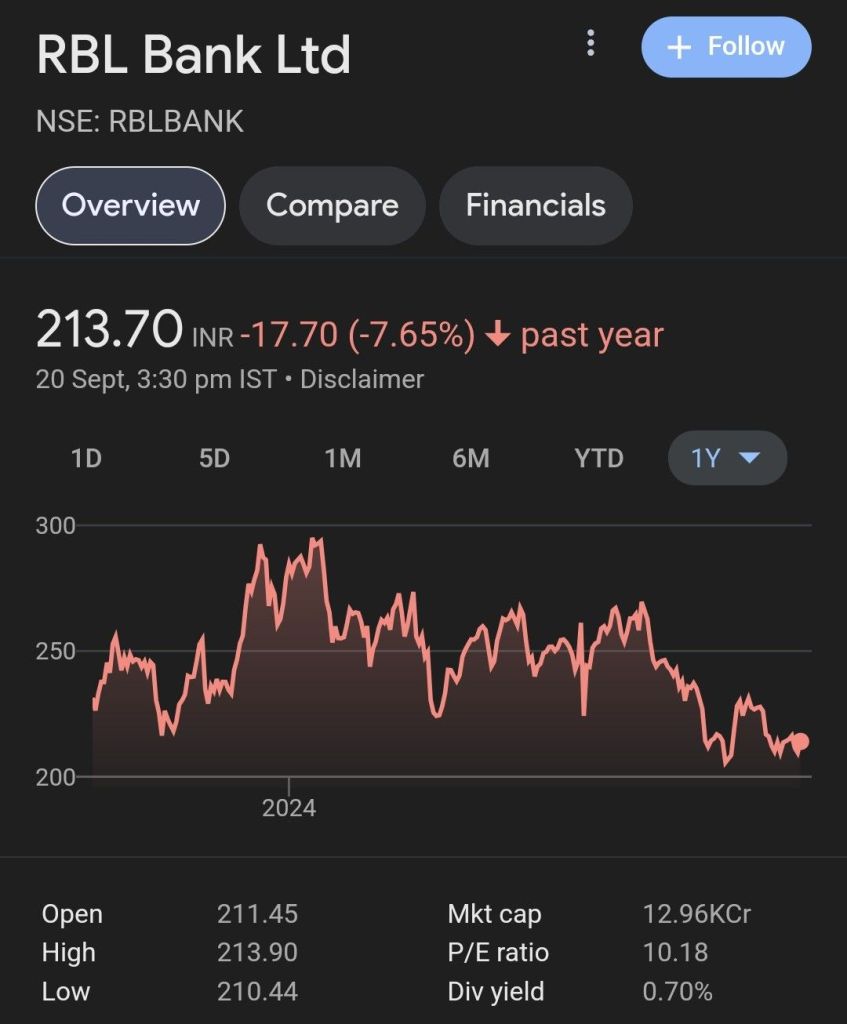

As a publicly traded company, the stock market capitalization is between ₹12000-₹13000 Crores (based on closure on Sept 20, 2024)

The graph above shows that RBL Bank has been a huge underperformer in the banking space despite Public & Private Banks showing good profitability in operations and returns to their investors.

So, before we start the analysis regarding the bank – we need to look into the valuation matrix for the bank.

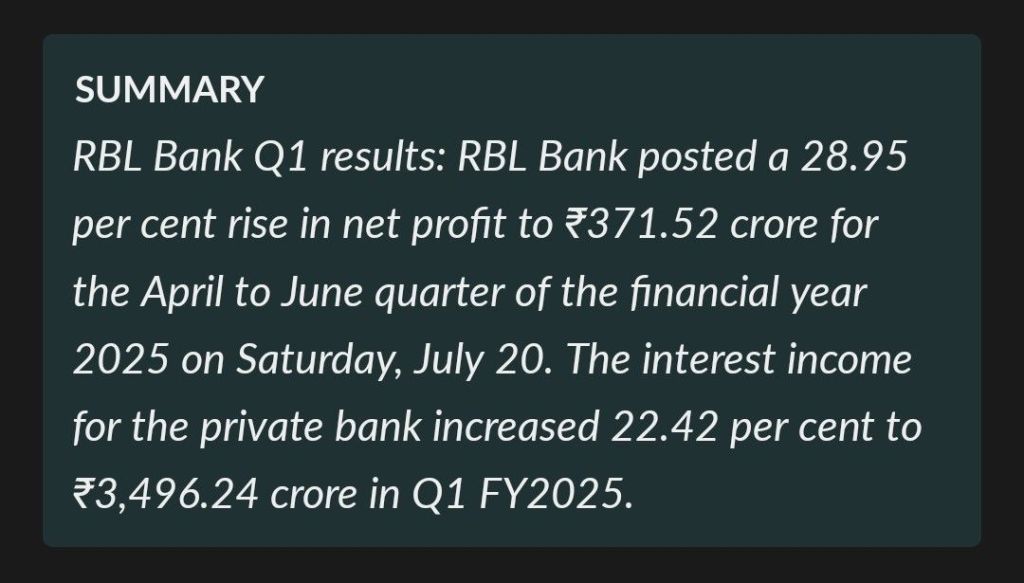

Also, let’s see the financial performance of the stock in the last quarter.

With a Bank trading below the Book Value, having P/E<15, and a Face Value of ₹10 – the stock of RBL Bank looks like a steal for investors looking for value and wanting to get a multi-bagger.

The scenario is much different though

The reason for the post is to bring to light the realities linked to RBL Bank despite the

- RBI permission to Quant Mutual Fund to raise stake in RBL Bank to 9.98% by May 12, 2025, in May 2024

- The decision by RBI not to appoint an independent director to the board of RBL Bank after the 2-year stint of the previous one ended in Dec 2023

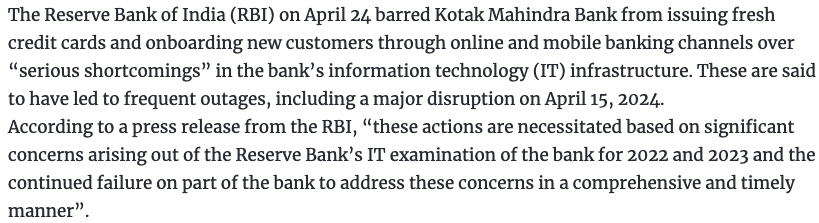

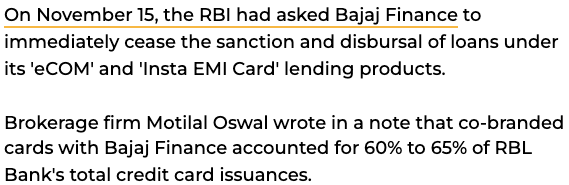

In the past few months, we saw RBI intervening to stop banks from giving personal loans, and credit cards, or opening online savings accounts.

RBI has taken similar action on the now-defunct – Paytm Payments Bank, and Urban Co-operative Banks, etc.

Now, coming to RBL Bank in this context

With regards to the ‘shortcomings’ – RBL Bank is the poster boy of mismanagement

In the year 2021, the RBI intervened in the Bank’s affairs and appointed an independent director for a period of 2years. Also, it pushed for the exit of the poster-boy MD and CEO, Vishwavir Ahuja in December 2021 – who had taken over the leadership role of the Bank in 2010.

The appointment of the current MD and CEO – R. Subramaniakumar, a banking veteran and former managing director and chief executive director of the state-run Indian Overseas Bank – has the RBI footprint all over it. (Ref).

So, what is ailing the bank so much?

The reasons are many but would like to summarize them in brief

- Despite being a private sector bank, its operations are run like a Government Bank with minimal focus on customer needs

- Lack of proper due diligence process in loan sanction to corporate clients or retail thereby leading to the recurring cycle of NPA(Non-Performing Assets)

- Lack of creativity linked to loan products or investment products. The emphasis is more on sales of partner-defined products(like ULIPs, Credit Cards, Insurance, etc.) rather than developing something in-house

- Lack of Geographical Diversity with more concentration of banks in Maharashtra and Karnataka

- Low investment in the technology backbone development for bringing ease to clients and upholding transparency

So, an investor who is looking to safeguard their money while making returns – will understand that the reasons mentioned here are not small but a cultural issue that needs radical changes for rectification.

Mutual Fund Managers like Quant will buy-sell-hold as needed as Mutual funds have better taxation terms as compared to Individual Investors.

Do your research and invest wisely

Hope this Helps

God Bless!

Leave a comment