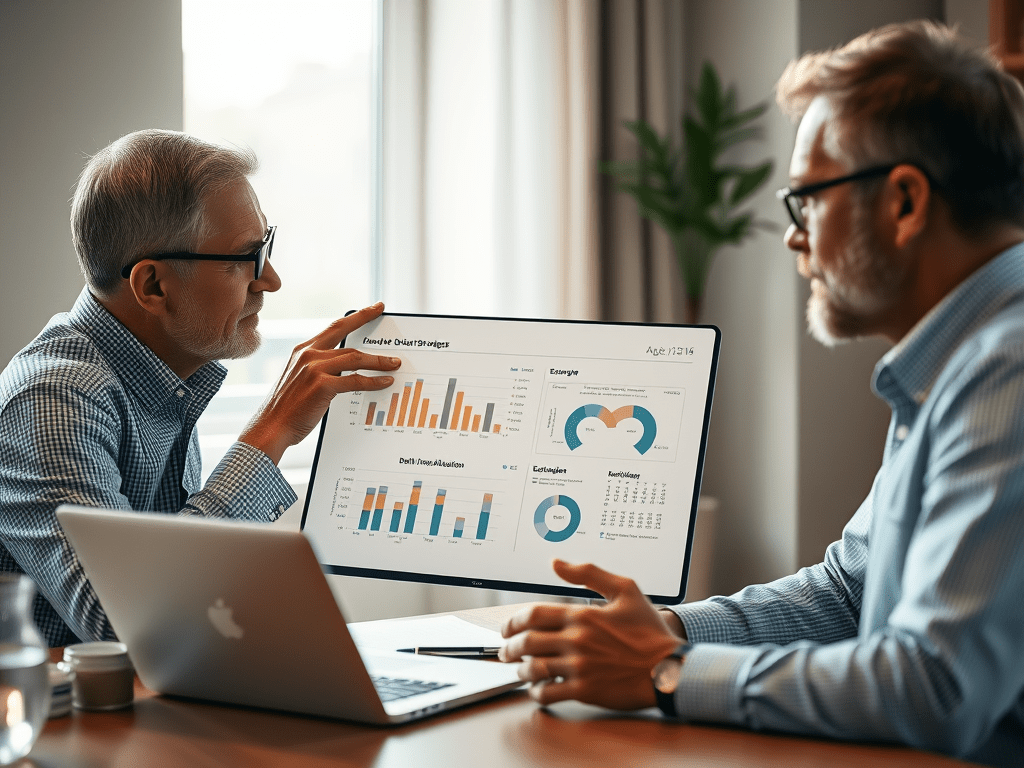

In investing, there is a rule of thumb

Investment into Equities % = 100 – Age

The reason for having this is to ascertain that the risk taking appetite is inline with your age and responsibilities.

In your case, Investment into Equities = (100 – 46) = 54%

Taking this ahead, you can split your investment as follows

- Equity (54%)

- Equity Oriented Mutual Funds – 90% of the total allotment

- Equities – 10% of the total allotment

- Debt (16%)

- Debt Oriented Mutual Funds – 100% of the total allotment

- Small Savings (10%)

- PPF, NSC, KVP

- Pension Scheme (10%)

- National Pension Scheme (NPS) (Do not invest in pension schemes provided by Insurance Companies)

- Liquid Money (10%)

- High Interest Rate Savings Account

- Flexi-Deposits

- Liquid Funds

You can accordingly spread your money out considering the capital you are having in hand to proceed.

For Equity investments, minimum waiting time for seeing substantive upsides is 5–7years minimum. If you do not have the patience then better invest in fixed deposits.

Hope this helps

You can also read an earlier post

Is Investing through Registered Investment Advisor or Mutual Fund Distributor a good idea?

All the best

Happy Investing and God Bless!

About the Post Author:

The Author is an AMFI registered Mutual Fund Distributor (ARN-262589). Reach out to him via email: edteficonsult@gmail.com