As we are hearing a lot that FIIs are selling and because of this, the Indian Market is suffering. 😵😮💨😵

FIIs or Foreign institutional investors who are chasing returns in all the markets including the US to make returns for their customers.🤠

At present, many of them are selling from India on a daily basis and leaving😥😥😥

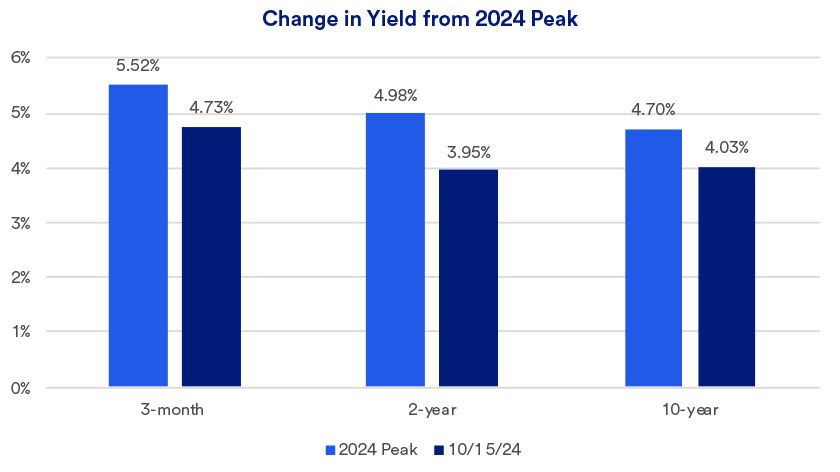

Reason – Bond Yield Inversion

In the US, a treasury yield inversion occurs when the interest rate on short-term U.S. Treasury debt is higher than the interest rate on long-term debt.

Normally, shorter-term securities have lower yields than longer-term securities.

An inverted yield curve, also known as a negative yield curve, indicates that investors are paying more for short-term bonds than long-term bonds.

At present, US T-Bill yields

– 4.43% for 3-months duration 🤯

– 4.2% for 1+ year duration ☹️

This is alarming as people are getting more returns on the short-term rather than long term. This return is risk-free!

Owing to this, FIIs are pulling money out from India & other emerging markets and putting it into US Treasury Bonds/Bills with less than 6 month duration to capitalise on this anomaly..🫣🫣🫣😱

If Indian Companies do not improve earnings or there is no rate cut in the December 2024 RBI meeting – a lot of FII may not come back to India anytime soon….😦😦

Leave a comment