APM (Administered Price Mechanism) gas is natural gas produced from legacy fields operated by companies such as ONGC and Oil India Ltd., under the supervision of the Indian government. These fields have a lower cost of production, and the gas price is regulated by the government to ensure affordability for priority sectors.

The APM gas price is revised every 15 days based on different factors like crude oil indexation, revision to reflect supply-demand, other events, etc.

APM Gas Allocation in India

The government allocates APM gas to priority sectors like:

- City Gas Distribution (CGD): Used for domestic PNG (piped natural gas) and CNG (compressed natural gas). Examples of them are MGL(Mahanagar Gas Limited) in Mumbai & IGL (Indraprastha Gas Limited) in Delhi NCR

- Fertilizer: For urea production to ensure low-cost agricultural inputs

- Power: For electricity generation in plants with specific allocations

Impact of APM Gas on CGD Profitability

The allocation of APM gas at subsidized rates significantly influences the profitability of CGD entities, especially those serving domestic PNG and CNG markets as follows:

1. Cost Advantage for CNG and PNG:

- CGD companies that receive higher allocations of APM gas for their CNG and domestic PNG segments enjoy a cost advantage

- Lower input costs enable them to offer competitive pricing to consumers while maintaining healthy profit margins

2. Differential Allocation and Regional Disparity:

- APM gas allocations vary based on demand, government priorities, and regional requirements

- CGDs in regions with larger APM allocations are more profitable compared to those that rely on expensive imported LNG (liquefied natural gas) to meet additional demand

3. Sensitivity to Price Changes:

- When APM gas prices rise, CGDs face margin pressures unless they pass on costs to consumers (which becomes difficult in an inflationary or election environment)

- Those reliant on imported LNG are more exposed to global price volatility, which can erode profitability

4. Consumer Preference for CNG:

- Lower APM gas prices lead to attractive CNG pricing, encouraging a shift from petrol/diesel to CNG vehicles. This boosts sales volumes and profitability for CGDs with sufficient APM allocation

5. Policy and Allocation Adjustments:

- Any changes in government policy regarding APM allocation—for instance, reducing APM gas for CGDs in favor of other sectors—can negatively impact profitability, especially for smaller or newer CGDs in less developed markets

Example of Regional Impact:

- CGDs in metro cities like Delhi and Mumbai, which have significant APM allocations, can price CNG and PNG competitively, driving high adoption rates

- Smaller towns or newly developed CGD networks might struggle if they rely more on costly LNG imports, affecting margins

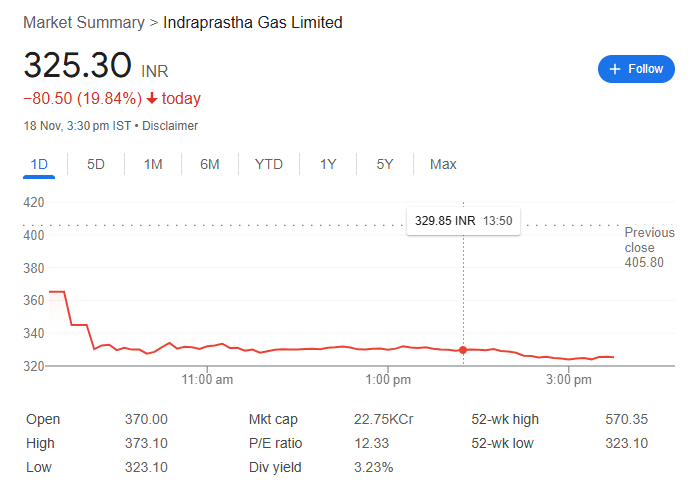

On November 18th, 2024 we saw a huge crash in the share prices of CGDs like IGL, MGL and GSPL.

This is owing to the Government slashing the Administered Price Mechanism (APM) allocation to CGD players by ~20% in the month of October 2024 and November 2024. (Link)

To counter this drop in allocation, CGDs need to focus on diversifying their sourcing of Gas, pass on increase in Gas procurement to the customers and venture into new business verticals. Without this, staying profitable may be difficult for the company and non-value adding to the investors.

Conclusion

APM gas allocation is a critical driver of the financial health of CGDs in India. Regions and entities with substantial allocations are better positioned to capitalize on growing demand for CNG and PNG. However, as the demand for natural gas rises, reliance on imported LNG will increase unless domestic production scales up or allocation policies are revised to ensure equitable distribution.

Hope this helps you get an idea regarding APM and how it impacts CGDs.

Follow my blog for more content on Investing, Geopolitics, Technology, Astrology and Finance.

God Bless!

Leave a comment