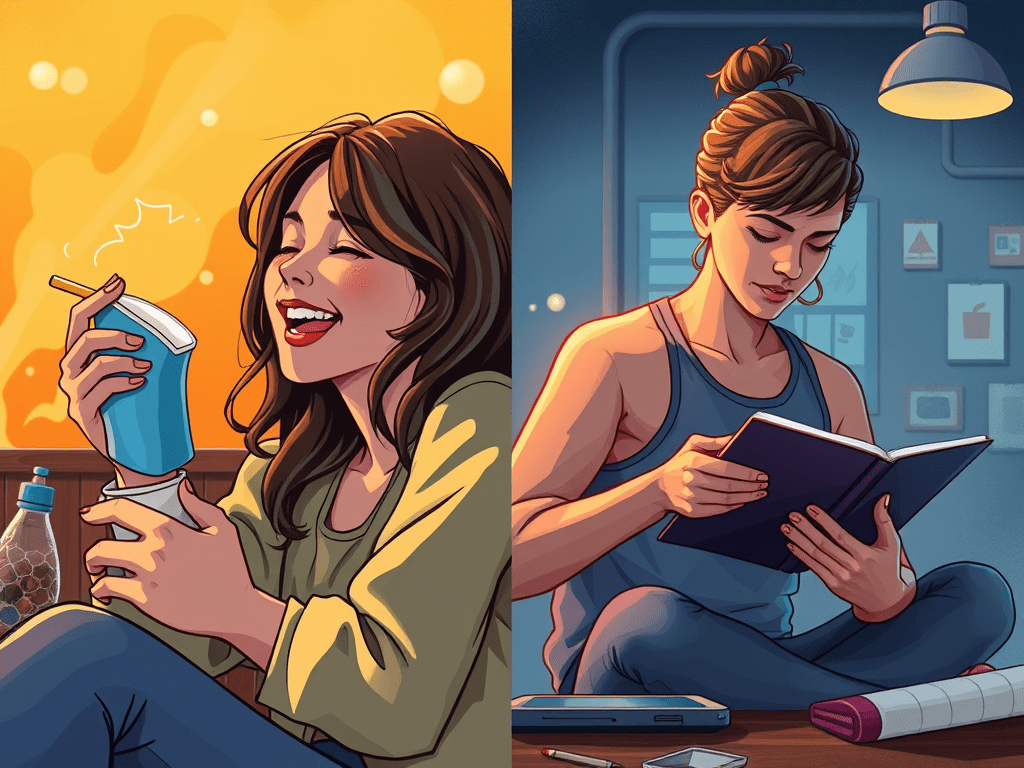

Short-term gratification refers to the desire for immediate pleasure or rewards rather than waiting for long-term benefits.

It often drives impulsive decisions, such as indulging in unnecessary expenses or avoiding long-term goals for momentary comfort.

What is its Impact on our Life?

- Personal Growth: Limits self-discipline and focus on long-term goals, hindering skill or career development

- Health: Encourages unhealthy habits like overeating or skipping exercise for comfort or laziness

- Relationships: Can cause strain when impulsive actions overlook shared long-term objectives

What is its Impact on Savings and Financial Health?

- Overspending: Leads to unnecessary purchases, reducing available funds for essentials or investments

- Debt Accumulation: Increases reliance on credit for wants rather than needs

- Missed Opportunities: Prevents wealth-building through investments, compounding, or saving for big goals

How to Tackle the ‘lure’ of Short-Term Gratification?

- Set Clear Goals: Define long-term objectives (e.g., buying a house, retirement savings) and revisit them regularly

- Budget and Track Expenses: Allocate specific amounts for spending, saving, and investing to maintain financial discipline

- Delay Purchases: Use the 24-hour rule before making non-essential purchases to curb impulsive buying

- Celebrate Small Wins: Reward yourself in moderation when reaching milestones to balance gratification and discipline

- Build Habits Gradually: Start with small steps like saving 10% of income or preparing meals at home to reduce unnecessary expenses

By addressing short-term gratification consciously, you can align daily actions with long-term aspirations.

Leave a comment