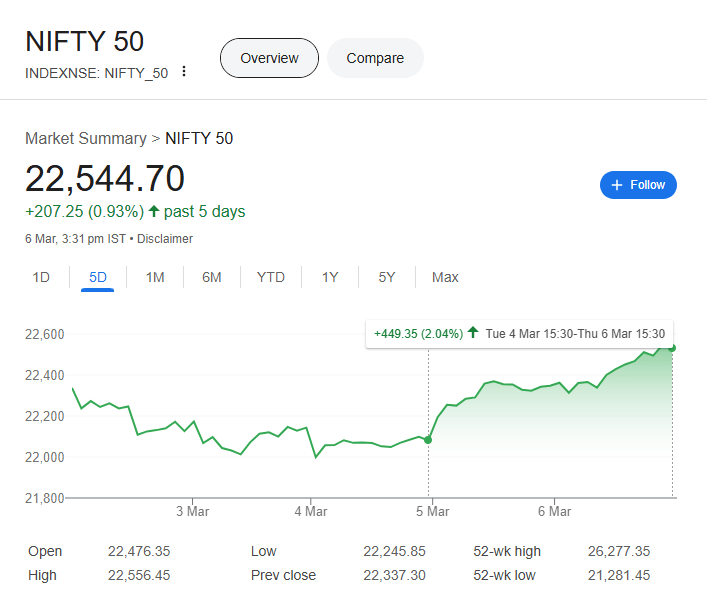

The Indian stock market has rebounded since March 5, 2025, driven by multiple factors.

Sensex and Nifty indices surged, supported by strong buying across sectors due to the following reasons

- IT stocks led the recovery, with companies like Coforge and Persistent Systems gaining significantly due to positive growth outlooks

- Metal stocks also rallied, benefiting from declining oil prices and improved global sentiment

- Midcap and small-cap indices saw robust gains, reflecting investor confidence in undervalued stocks

- The Reserve Bank of India’s liquidity measures, including bond purchases, further bolstered market sentiment

- Sectors like auto, PSU banks, and realty also experienced notable recoveries, driven by value buying and favorable macroeconomic indicators

- Easing global trade tensions and optimism around China’s economic growth contributed to the positive momentum

Overall, the market’s rebound reflects a combination of domestic policy support and improving global conditions.

Direction to Mid & Long-term Investors: Wait and Watch before making fresh huge allocations

Leave a comment