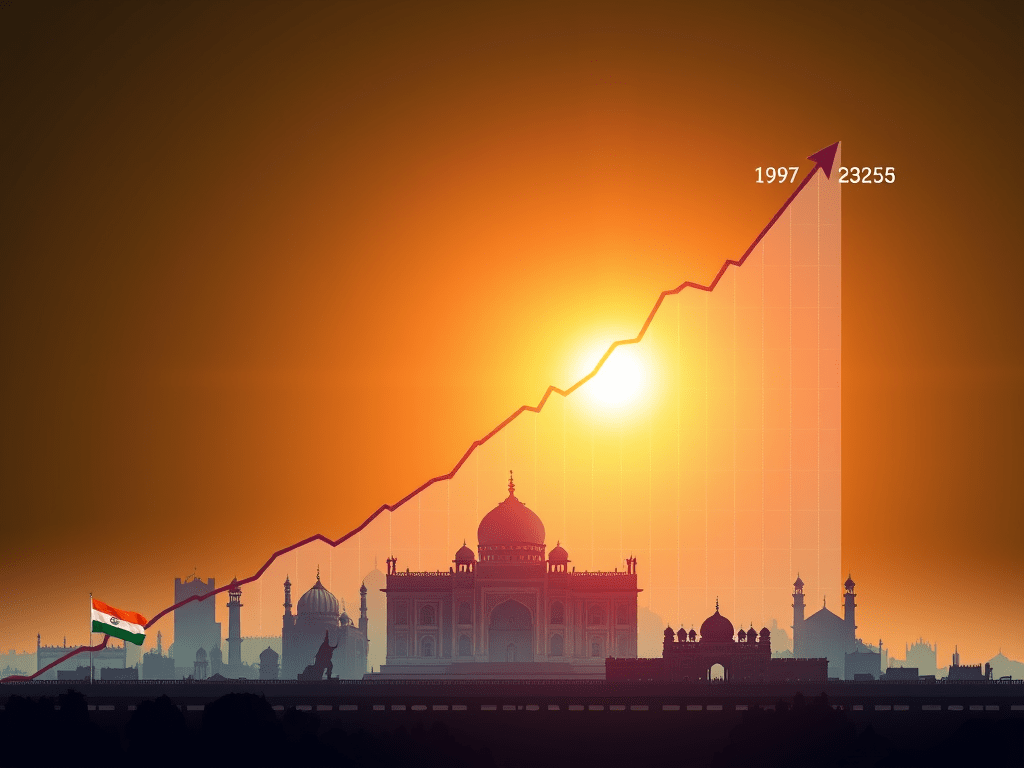

The BSE SENSEX, India’s premier stock market index, has been a barometer of the nation’s economic journey since its inception.

Starting with a base value of 100 in 1979, the SENSEX has showcased remarkable growth over the decades.

Growth Trajectory and CAGR:

As of March 9, 2025, the SENSEX stands at 74,332.58. Calculating the Compound Annual Growth Rate (CAGR) from its base value of 100 in 1979 to its current level:

Compound Annual Growth Rate (CAGR) ≈ 15-16%

This impressive CAGR of approximately 15-16% over 46 years underscores the robust performance of the Indian equity market.

Pivotal Milestones Influencing SENSEX Movements:

- 1991 Economic Liberalization: The introduction of liberal economic policies under Prime Minister P.V. Narasimha Rao and Finance Minister Dr. Manmohan Singh led to rapid industrial growth and increased foreign investments, propelling the SENSEX beyond the 2,000 mark in January 1992

- Dot-com Boom (1999-2000): The late 1990s saw a surge in technology stocks globally. The SENSEX mirrored this trend, crossing 6,000 points in February 2000, driven by the IT sector’s exponential growth

- 2008 Global Financial Crisis: The collapse of major financial institutions worldwide led to a sharp decline in global markets. The SENSEX was not immune, witnessing significant downturns during this period

- 2014 General Elections: The decisive victory of the Bharatiya Janata Party (BJP) instilled optimism among investors, leading the SENSEX to surpass the 25,000 mark for the first time in May 2014

- 2020 COVID-19 Pandemic: The global pandemic led to unprecedented volatility. However, swift policy responses and economic stimuli facilitated a rapid recovery, with the SENSEX reaching new heights in subsequent years

- 2024 U.S. Federal Rate Cuts: In September 2024, a significant 50-basis point rate cut by the U.S. Federal Reserve boosted global investor sentiment. This move, coupled with positive economic data from the U.S., propelled the SENSEX beyond the 84,000 mark for the first time, reflecting enhanced risk appetite and liquidity inflows

Conclusion:

The journey of the BSE SENSEX from a humble 100 points in 1979 to over 74,332.58 in 2025 epitomizes India’s economic resilience and growth. While the CAGR provides a snapshot of this growth, the index’s trajectory has been shaped by a confluence of domestic reforms and global events.

As India continues its economic ascent, the SENSEX remains a testament to the nation’s dynamic market landscape.

Leave a comment