When it comes to building long-term wealth, few strategies are as powerful and practical as investing regularly in Mutual Funds through SIP (Systematic Investment Plan) and later enjoying the benefits of SWP (Systematic Withdrawal Plan).

Let us explore how discipline + time + compounding can lead to an income that doesn’t run out — literally.

Phase 1: SIP – Building Wealth

Suppose you invest ₹10,000/month in an equity mutual fund through SIP for 25 years. Assuming a 12% annual return, here’s what your corpus becomes:

Monthly SIP = ₹10,000

Investment Duration = 25 years (300 months)

Expected Return = 12% annually

Invested Amount = ₹30 Lakhs

Final Corpus = ₹1.7 Crore (approx)

This is the magic of compounding — the longer you stay invested, the more your money grows, not just on the principal but also on the returns it has already generated.

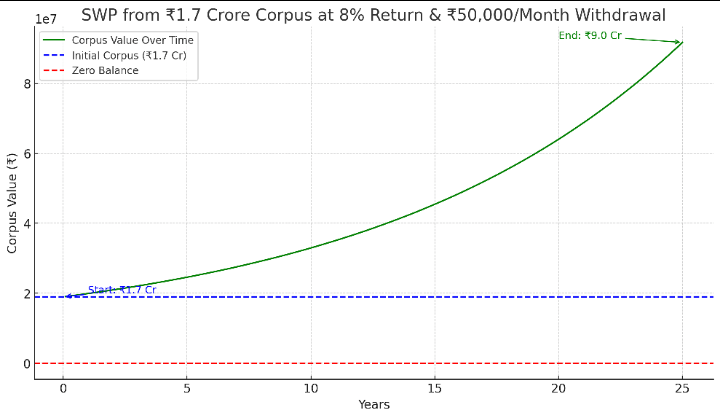

Phase 2: SWP – Creating a Perpetual Monthly Income

Now, let us say you retire and start a monthly SWP of ₹50,000 from the ₹1.7 crore corpus. Once you reach this value, there is no further monthly investment made.

Assuming your money continues to earn 8% annually (conservative estimate), let us see if this lasts:

Initial Corpus: ₹1.7 Crore

SWP Amount: ₹50,000/month

Annual Return: 8%

Expected Tenure: Forever?

Using a SWP calculator, at 8% return, if you withdraw ₹50,000/month:

The corpus lasts indefinitely, because the annual return (~₹13.6 lakh) is greater than the annual withdrawal (₹6 lakh) – the corpus continues to grow!

Bottom Line:

The above-stated strategy is perfect for individuals seeking:

– Wealth creation without timing the market (thanks to SIP)

– Regular income without fear of running out of money (thanks to SWP)

– Peace of mind and financial independence

So start your SIP today, stay consistent, and let compounding do the heavy lifting while you relax and let your money work for you forever.

Share this with people who will appreciate the power of compounding and the power of systematic withdrawal 😇😊.

Disclaimer:

1) Stock Market Investing via Equity Route, which includes – Stocks/Shares, ETFs, Mutual Funds, and Index Funds, is susceptible to fluctuations owing to domestic and international events

2) If your investment horizon is less than 7-10 years and you cannot see your investment go down, then Equity Investing is not meant for you

3) Indian Benchmark Indices (like Nifty 50 and BSE S&P 30) over 10 years have given more than 13-16% annualized returns(pre-tax). This is much higher than the safe returns of 6.5-7.5% from debt instruments like FDs, NSC, RD, etc.

Leave a comment