Introduction:

Krishna Defence and Allied Industries Ltd. is a publicly listed Indian company specialising in the design, development, and manufacture of a diverse range of equipment for the defence, security, dairy, and mega kitchen sectors.

It was founded in 1996 and is headquartered in Mumbai. The company has established itself as a key player in the “Make in India” initiative, focusing on indigenous solutions that reduce reliance on imports and support India’s defence ecosystem.

Areas of Focus:

- Defence and Security: It manufactures critical assemblies and precision components for the Indian Navy and Army, like

- Specialised steel sections for shipbuilding

- Bulb bars, threat management systems, barricades, police stingers, and boat stopping mechanisms

- Essential components for warships and other defence platforms, emphasising in-house development and innovation

- Dairy Equipment:

- Milking machines, milk chillers, robotic milk collection units, and stainless steel milk cans

- Mega Kitchen Solutions:

- Large-scale kitchen equipment used by government agencies and NGOs (used in the preparation of mid-day meals for schools and large organisations, especially in remote areas)

Recent Developments Linked to the Company:

- Operational Improvements:

- Debtor days reduced from 135 to 89.6

- Promoter holding has increased to 62.27% as of March 2025 (growing confidence in the company’s prospects)

- Manufacturing Capabilities:

- Invest in state-of-the-art manufacturing facilities

- Enabling the production of critical high-precision components with stringent quality controls and multi-level inspections

- Defence Order Book: Krishna Defence boasts a robust order book is approx INR 200 Crores

Companies Performance(as of May 2025):

| Metric | Value |

|---|---|

| Market Capitalization | ₹1,262 crore |

| Revenue (FY 2024) | ₹165 crore |

| Profit (FY 2024) | ₹17.8 crore |

| Promoter Holding | 62.27% |

| Sectors | Defence, Security, Dairy, Mega Kitchen |

| Notable Clients | Indian Navy, Indian Army, Government Agencies |

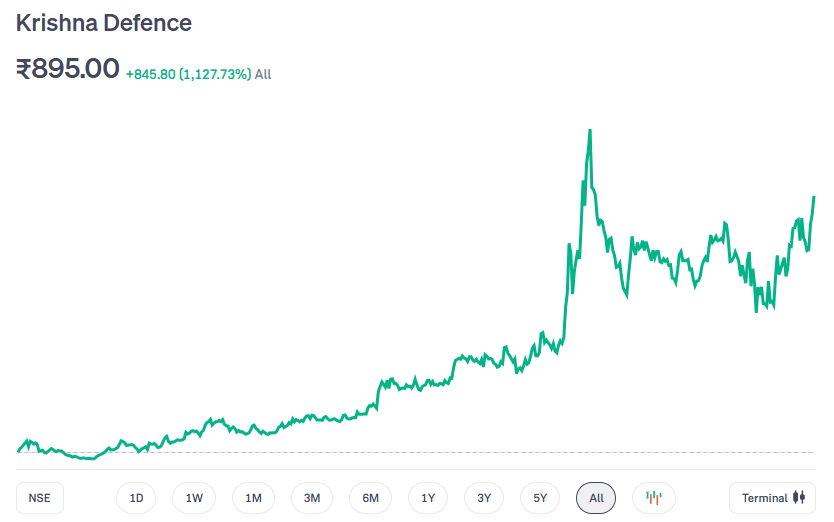

Companies Stock Performance(as of May 2025):

Market Cap: ~1200 Crores (Small cap)

~1100% returns since its listing in April 2022 (CAGR ~ 120%/year for the past 3 years)

Price to Equity (P/E) = ~120 (very very expensive)

Price to Book Value (P/B) = ~12.79 (very expensive)

Debt to Equity = 0.11 (good indicator)

EPS = ~7 (very poor considering the pricing)

Promoter Holding dipped between March to May 2024 from 68% to 62%, but has remained the same in the past year. This fluctuation needs to be kept as a caution for any new investors who are evaluating this stock

Negligible Holding of Big Investors – FII and DII (Point of concern as big investors have given the stock a miss)

RoCE: ~17% (Average considering its small-cap status)

Outstanding Shares: 1.41 Crores

Volume Traded(daily): ~50000 (Not illiquid but not completely fluid as a midcap or largecap stock, which has volumes greater than 10 lac shares per day)

Stock from Peak: ~20% below peak value (Indicator of Keep in watch)

Final Takeaway:

Krishna Defence and Allied Industries Ltd. aims to support the Indian government, public sector undertakings, and private customers through continuous improvement in its products and services.

The stock is currently very expensive, and it needs to work on improving the ROCE and order book.

The company share price as on date May 19th, 2025 – INR 896 is still more than ~60%(INR 532) above the value it traded on March 3-4, 2025.

For investors still considering investing after reading the entire blog need to understand the areas and valuation.

A minimum of 20-25% of the current value is essential to consider before entering the stock.

Happy Investing!!

References:

- https://www.screener.in/company/KRISHNADEF/

- https://in.linkedin.com/company/krishnaallied

- https://krishnaallied.com

- https://www.business-standard.com/markets/krishna-defence-allied-industries-ltd-share-price-76486.html

- https://krishnaallied.com/wp-content/uploads/2023/09/ANNUAL-REPORT_KDAIL_2022-23.pdf

- https://krishnaallied.com/wp-content/uploads/2024/07/Krishna-Defence_AR-2023-24.pdf

- https://markets.ft.com/data/equities/tearsheet/profile?s=KRISHNADEF%3ANSI

- https://www.milkingsolution.com

- https://www.moneycontrol.com/india/stockpricequote/defence/krishnadefencealliedindustries/KDA

- http://www.dulsopac.du.ac.in/video/Krishna-Defence-and-Allied-Industries-Limited-(KRISHNADEF)-Stock-Rallies

Leave a comment