Please note: This is not a recommendation, advice, or a tip to make quick money.

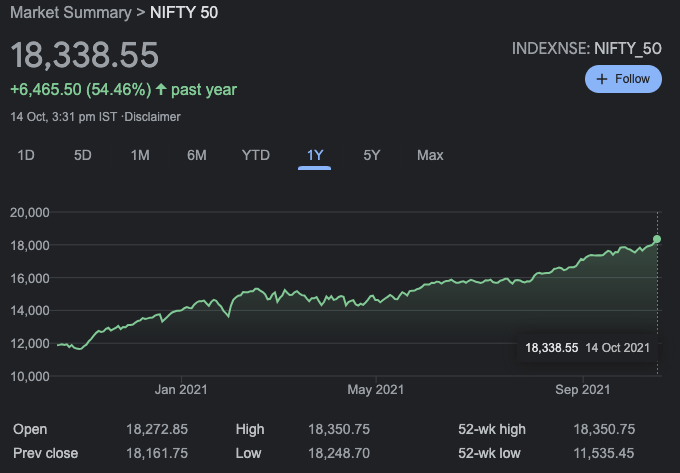

If an individual wants to start their journey towards financial independence or make their money work towards a future goal, then the best approach would be the financial markets, and the best vehicle would be equity-related investments.

Having said that, a few things need to be noted

- Focused allocation of money every month

- The horizon of a minimum of 18–24 months

- Stay away from speculation/tips or expert advice from someone known/unknown

- Invest money according to your time in the markets

- Novice/Beginner: Mutual Funds

- Mid-level: Large-Cap Stocks + Mutual Funds

- Expert: Stocks(Large-Cap & Mid-Cap) + Mutual Funds

Now comes the question:

Best long term SIP of INR 500 (US $6.6) in October 2021

Query by a curious investor

Despite the low amount of money, the investor can find some avenues for deployment in the Equity-linked Vehicles:

- Stocks

- Large Cap

- ITC

- SBI

- Mid Cap

- Tata Power

- BEL

- CESC

- Large Cap

- Mutual Fund

- Balanced

- ICICI Balanced Advantage Fund

- ELSS

- Mirae Asset Tax Saver Fund

- Equity

- Axis Bluechip Fund

- Kotak Bluechip Fund

- Tata Largecap Fund

- Balanced

Invest wisely and create wealth for the long run

Hope you find this helpful, and feel free to share with others

Please note: This is not a recommendation, advice or a tip to make quick money.

Leave a comment