Investing in the stock market during corrections or bear markets can be a strategic move for long-term investors. These periods often present opportunities to acquire quality stocks at discounted prices, potentially leading to substantial gains when markets recover.

Emphasizing value-based growth during these times can significantly enhance investment outcomes.

Understanding Market Corrections and Bear Markets

A market correction is typically defined as a decline of 10% or more in stock prices from recent highs, while a bear market signifies a more prolonged downturn, with prices falling 25% or more.

Such phases, though challenging, are inherent to market cycles and can set the stage for future growth.

The Rationale for Investing During Downturns

- Attractive Valuations: During market downturns, even fundamentally strong companies may experience significant price declines, allowing investors to purchase shares at valuations lower than their intrinsic worth.

- Potential for Higher Returns: Investing during bear markets can lead to substantial returns as markets recover. Historical data indicates that markets often rebound robustly after downturns, rewarding patient investors.

- Reinforcing Value-Based Growth: Focusing on companies with strong fundamentals, such as consistent earnings, robust balance sheets, and sustainable business models, can provide a margin of safety and enhance the potential for long-term growth.

Case Studies: Stocks That Rebounded Post-Crash

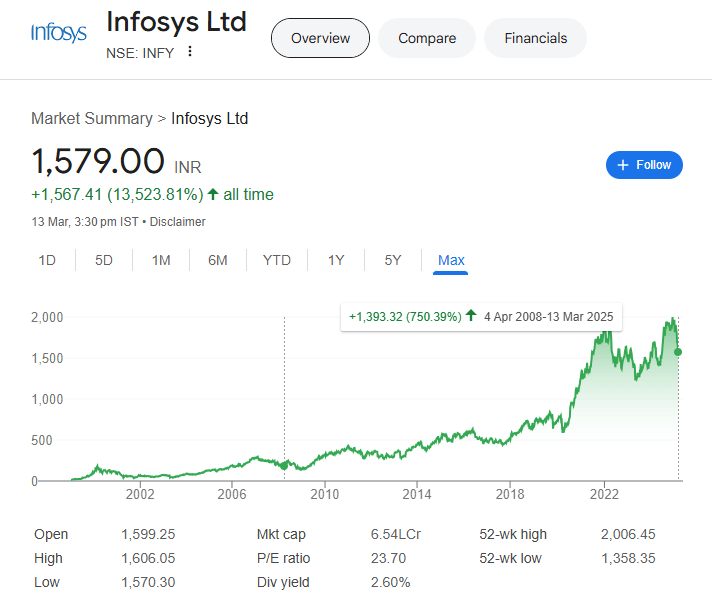

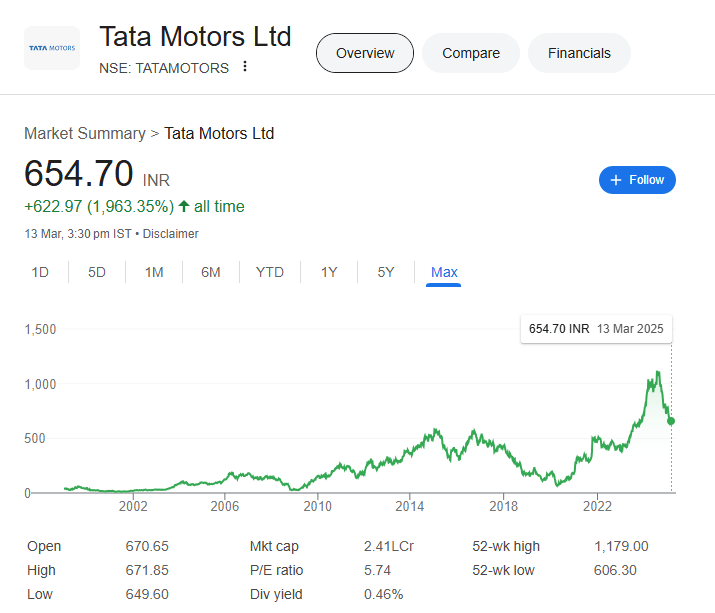

Indian Stock Market: Returns do not include Dividends Paid Out

- Infosys Limited: During the 2008 global financial crisis, Infosys’s stock price declined significantly. However, as the market recovered, the company’s strong fundamentals and consistent performance led to a substantial rebound, rewarding long-term investors.

- State Bank of India (SBI): In the aftermath of the 2008 crisis, SBI’s stock faced considerable declines. Nonetheless, its pivotal role in the Indian banking sector facilitated a strong recovery in the subsequent years.

- Tata Motors: The 2008 downturn saw Tata Motors’ shares plummet. Yet, with strategic initiatives and a focus on innovation, the company bounced back, offering significant returns to investors who remained steadfast.

U.S. Stock Market: Returns do not include Dividends Paid Out

- Amazon.com, Inc.: During the 2000 dot-com bubble burst, Amazon’s stock price dropped sharply. Investors who recognized the company’s long-term potential and held their positions witnessed remarkable gains in the following years.

- Apple Inc.: In the early 2000s, Apple’s stock experienced significant declines. However, the company’s commitment to innovation and value creation led to a dramatic resurgence, benefiting long-term shareholders immensely.

- Nvidia Corporation: The 2008 financial crisis led to a substantial drop in Nvidia’s stock price. Investors who focused on the company’s strong fundamentals and growth prospects were rewarded as the stock soared in the subsequent bull market.

Conclusion

Investing during market corrections or bear markets requires a disciplined approach and a focus on value-based growth. By identifying and investing in fundamentally strong companies during these periods, investors can position themselves for substantial gains when markets recover.

Patience, thorough research, and a long-term perspective are essential to harness the opportunities presented by market downturns.

Happy Investing!!!

Thank you for this Insightful Post Sir 😊

God Bless 🍀

LikeLiked by 1 person