Basics about Indian Pharma

The Indian Pharma industry has come a long way since the 1970s, where the country has become one of the largest contributors to the biotech workforce in the world[8].

India with its youth population and network of universities & research labs has been able to generate a pool of researchers who can take the Indian Pharma industry to higher echelons. The future indeed seems to be interesting!!

Fig 1. Indian Pharma Industry[11]

As a component of the Global Pharma Trade, Indian Pharma’s valuation is less than 4% but it supplies medicinal drugs around 10% by volume[8].

Amazing isn’t it??

Indian Pharmaceutical industry was not always adored. It was a marginal player in pharmaceutical manufacturing until the 1970s.

But today, India supplies not only to the USA & Europe but also to Africa and South America.

How did this transformation happen?

A number of targetted measures helped the India Pharma industry to unleash its true potential[9].

What were the modalities of it?

To understand this, let us delve into history…….

The first initiative to nurture local pharmaceutical companies was taken when amendments were made to the Patent Act of 1970 which capped the patent validity to 7 years and introduced the New Drug Policy of 1978[14].

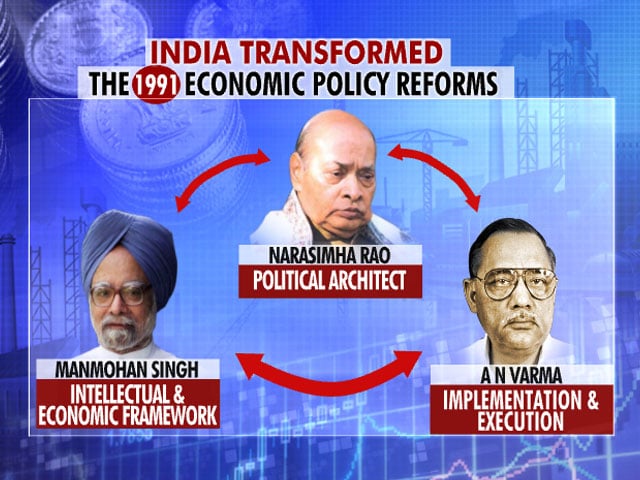

Fig 2. Economic Liberalization in the 1990’s[13]

Also, as a part of the liberalization policy, the Government of India in the New Drug Policy(NDP) of 1994 & 2002 made some significant changes[8][9][10][13][14]

- Abolishment of the licensing requirement for entry and expansion of firms

- Foreign Direct Investment(FDI) up to 100% under the automatic approval route from the Reserve Bank of India(RBI)

- Automatic approval for technological collaboration

- Allow free import of formulations, bulk drugs & intermediaries

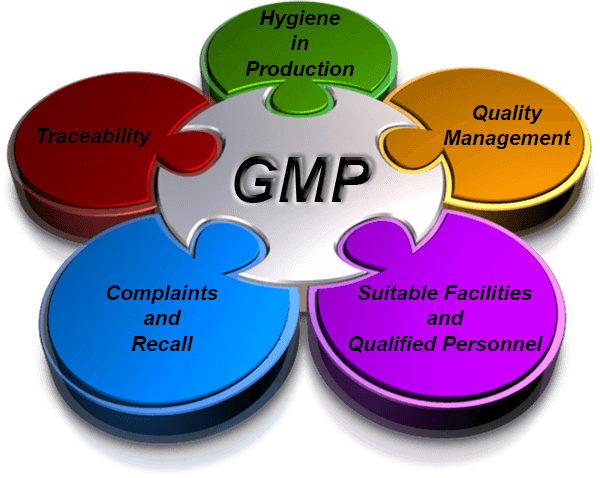

The NDP architecture has improved adherence to conventions like Good Manufacturing Practice(GMP), which is necessary for competence building.

Fig 3. GMP in Pharmaceutical Industry[21]

FDI, NDP and other focused interventions like these have helped Indian Pharma carve out a niche for itself in the global pharmaceutical supply chain. Indian Pharmaceutical Companies are now a dominant player in areas like[8][9][10]

- Innovative Generic drugs

- Formulations of Active Pharmaceutical Ingredients (API)

- Cost-Effective Outsourced Clinical Research & Contract Manufacturing and Research from developed countries

- US FDA-approved Manufacturing Facilities within & outside the country

- Continuous filing of Abbreviated New Drug Applications (ANDA)

The Department of Pharmaceuticals has envisioned ‘Pharma Vision 2020’ which aims to make India a major hub for end-to-end drug discovery[18][20][22][23][24].

Fig 4. Drug manufacturing in the Pharmaceutical Industry[25]

The government is trying to promote “Make in India” in order to convert India into a manufacturing & innovation hub. Under this, 100% FDI has been allowed through an automatic route for Greenfield projects. For Brownfield pharmaceutical projects, FDI has been allowed up to 74% through automatic route and beyond that through government approval[16].

The decision to open up the pharma sector has been under review by the government since 2015[17]. Recently, a parliamentary panel red flagged this issue saying that pharma sector in India is meant for the benefit of the society at large[15][17]. Also, the government should not cave-in regarding the Trade-Related Aspects of Intellectual Property Rights(TRIPS) agreement.

Background of Marksans Pharma

Since Indian Pharma Companies are being hit with regulatory compliance issues that affect their market cap and brand value.

Considering this, is it a good time to invest in pharma taking valuations into account?

Let us talk about one company in particular – Marksans Pharma

Marksans Pharma fell by ~40% in one week after it got a deficiency notice during an inspection for GMP from UKMHRA in January 2016[30].

So considering the volatility, let us try to understand whether the company is meant for investors/traders from the data available.

Firstly, Marksans Pharma was started in 2001 as a wholly–owned subsidiary of Glenmark Pharmaceuticals[1][7][26]. It got separated from the parent entity in March 2003 and was named as Glenmark Laboratories Ltd. which was subsequently rechristened as Marksans Pharma Ltd in 2005[26]

Focus Areas for Marksans Pharma

- Active Pharmaceutical Ingredient (API) research

- Contractual Research & Manufacturing Service(CRAMS) to Global Pharmaceutical companies

- Over the counter(OTC) & prescription drugs which have wide-ranging applications crosswise fields like oncology, diabetes, pain management, gynecology, cardiology etc.

As CRAMS is a focus area, it does contractual manufacturing to supply in developed markets[1][7][26]. The products and manufacturing facilities are as follows

1. Oral solid tablets, soft gelatin capsules etc. in Goa, India

2. Liquids/ointments/sachets in Southport, UK

3. Solid oral dosages facility in New York, USA

It also supplies products to approximately 20 countries. Its subsidiaries include Nova Pharmaceuticals Australasia Pty Ltd.[7][31] and Marksans Pharma (UK) Limited[7][32].

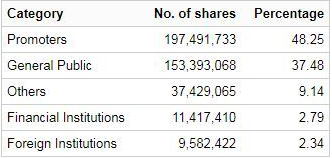

Shareholding Pattern

Fig 5. The shareholding pattern in Marksans Pharma[33]

The company’s top management includes Dr. Vinay Nayak, Ajay Joshi, Digant Parikh, Mark Saldanha, Seetharama Buddharaju and Sandra Saldanha[33]. The company has N K Mittal & Associates as its auditors as on 31/12/2017 and the company has a total of 409,313,698 shares outstanding[33].

Company Financials

Let us look into the parameters which help us decide whether the stock is worth a shot or just out-rightly ignore!!

Marksans Pharma Financial Summary[9][36][38]:

Face Value: Rs. 1

P/E: 37.97(Very Expensive!!!)

EPS: 0.89; Book Value: Rs. 10.24 & P/B: 3.16; Dividend Yield: 0.16%

52 Week Range: Rs. 31 – 58.25 & 200 Day Moving Average(DMA) – Rs. 41.13

Fig 6. Shareholding pattern in Marksans Pharma[37]

Debt-~Rs. 73.23 Cr. (Market Cap ~ Rs. 1383 Cr.)

Debt to Equity Ratio – 0.17 (Extremely Good!!)

Reserves & Surplus – ~Rs. 378.10 Cr(increased from Rs. 369.27 crores)

Sundry Debt borrowing ~Rs. 154.80Cr.(increased FY 17 from 133.41 in FY 16)

Liabilities increased from Rs. 503.26 crores to Rs. 463.32 crores.

Assets Increased to Rs. 503.25 Cr. from Rs. 463.31 Cr.

Competitors to Marksans Pharma

Fig 7. Marksans Pharma & it’s listed competitors with a similar business model[34]

Mutual Fund Exposure

Currently, no fund manager is deploying money earned in Marksans Pharma as it is

- Overvalued and

- Volatile due to the uncertainty surrounding the pharma sector with the US Food and Drug Administration(USFDA) raising many regulatory issues[4]

Marksans Pharma in News

- Q1 & Q2 of FY’18 saw some good uptick in profits despite a huge dip in bottom-line in the previous quarters.

- A big boost to profitability is owing to zero critical observations made by the UK Medicines and Healthcare products Regulatory Agency (MHRA) during the Goa plant inspection in February 2017[27].

Further Reading:

- http://www.business-standard.com/article/markets/marksans-pharma-soars-as-uk-mhra-finds-no-critical-observations-at-goa-unit-117022000264_1.html

- https://www.thepharmaletter.com/article/indian-pharma-shares-under-pressure-during-2017

Conclusion

Marksans Pharma works closely with regulators from different countries for drug approvals. This makes the stock vulnerable to corrections(like 2016) in light of some critical observations.

Commodity prices and global cues put additional pressure on realization making retail investors susceptible owing to their large share in the company.

Considering the above-stated facts, Marksans Pharma is not for investors who are looking for sudden windfall gains. It is a long-term bet which needs to be played out with discipline and a good understanding of global factors.

References

- https://m.economictimes.com/marksans-pharma-ltd/stocks/companyid-10542.cms

- https://www.indiainfoline.com/article/equity-earnings-result-commentary/marksans-pharma-q2fy18-consolidated-net-profit-rises-1286-7-yoy-117111300036

- http://profit.ndtv.com/stock/marksans-pharma-ltd_marksans/reports

- http://www.moneycontrol.com/india/stockpricequote/pharmaceuticals/marksanspharma/MP21

- https://www.ndtv.com/business/stock/marksans-pharma-ltd_marksans

- https://in.mobile.reuters.com/finance/stocks/overview/MARK.BO

- http://marksanspharma.com/company-profile.html

- https://www.ibef.org/industry/indian-pharmaceuticals-industry-analysis-presentation

- https://en.wikipedia.org/wiki/Pharmaceutical_industry_in_India#cite_note-4

- https://www.pwc.com/gx/en/pharma-life-sciences/pdf/global-pharma-looks-to-india-final.pdf

- https://www.pharmafocusasia.com/strategy/indian-pharma-promises

- https://www.youtube.com/watch?v=QUxaZaoYdjs

- https://www.ndtv.com/video/business/ndtv-special-ndtv-24×7/prannoy-roy-rakesh-mohan-on-25-years-of-economic-liberalisation-464133

- https://www.springer.com/cda/content/document/cda_downloaddocument/9783790828757-c2.pdf?SGWID=0-0-45-1353130-p174515562

- https://www.firstpost.com/economy/100-fdi-in-pharma-sector-bad-for-country-parl-committee-1035703.html

- http://www.makeinindia.com/documents/10281/114126/Pharmaceuticals+Sector+-+Achievement+Report.pdf

- https://www.wto.org/english/tratop_e/trips_e/intel2_e.htm

- https://economictimes.indiatimes.com/opinion/et-commentary/will-india-achieve-pharma-vision-2020/articleshow/28159936.cms

- https://www.pharmafocusasia.com/strategy/indian-pharma-promises

- https://www.ibef.org/download/Pharmaceutical-March-2017.pdf

- http://www.pharmamicroresources.com/2017/01/pics-guide-to-gmp-updated.html

- http://online.wsj.com/public/resources/documents/McKinseyPharma2020ExecutiveSummary.pdf

- https://economictimes.indiatimes.com/opinion/et-commentary/will-india-achieve-pharma-vision-2020/articleshow/28159936.cms

- https://www.theweek.in/content/archival/news/biz-tech/india-to-be-among-top-5-pharma-innovation-hubs-by-2020.html\

- https://www.livemint.com/Industry/1J4UbzMvgx0uKX7EQ6Og7J/Pharma-industry-seeks-extension-as-skill-certification-cuto.html

- http://marksanspharma.com/milestones.html

- http://www.business-standard.com/article/markets/marksans-pharma-soars-as-uk-mhra-finds-no-critical-observations-at-goa-unit-117022000264_1.html

- https://www.moneycontrol.com/news/business/usfda-vigil-on-indian-pharma-companies-to-become-more-stringent-2463559.html

- http://www.business-standard.com/article/companies/warning-letters-to-indian-pharma-companies-declining-says-study-118022100989_1.html

- http://www.business-standard.com/article/markets/marksans-pharma-up-10-after-falling-40-in-one-week-116011900577_1.html

- https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=39745676

- http://marksanspharma.com/mergers-acquisitions.html

- https://economictimes.indiatimes.com/marksans-pharma-ltd/stocks/companyid-10542.cms

- https://economictimes.indiatimes.com/marksans-pharma-ltd/stocks/companyid-10542.cms

- https://www.ndtv.com/business/stock/marksans-pharma-ltd_marksans/financials

- https://www.valueresearchonline.com/stocks/snapshot.asp?code=3996&colzscr=1

- https://www.google.co.in/search?q=marksans+pharma+share&oq=marksans+pharma+share&aqs=chrome..69i59j69i60l2j69i57j69i60j0.10065j0j7&sourceid=chrome&ie=UTF-8

- https://www.indiainfoline.com/company/marksans-pharma-ltd/3285

- http://marksanspharma.com/south-east-asia.html

- https://www.indiainfoline.com/article/equity-earnings-result-commentary/marksans-pharma-q2fy18-consolidated-net-profit-rises-1286-7-yoy-117111300036

- https://www.indiainfoline.com/article/equity-earnings-result-commentary/marksans-pharma-q1fy18-consolidated-net-profit-rises-177-yoy-117081100559

- https://www.indiainfoline.com/article/equity-earnings-result-commentary/marksans-pharma-q4fy17-standalone-net-profit-declines-88-8-yoy-117052900268

Like!! Really appreciate you sharing this blog post.Really thank you! Keep writing.

Thanks for your appreciation! 🙂